Business Atelier - Tax Planning Tips para #entrepreneurs 📆Crea un calendario para acordarse de fechas o plazos importantes. 🖐Mantenga a la mano documentos importantes como #estados de #cuenta, balance, recibos de compras, #

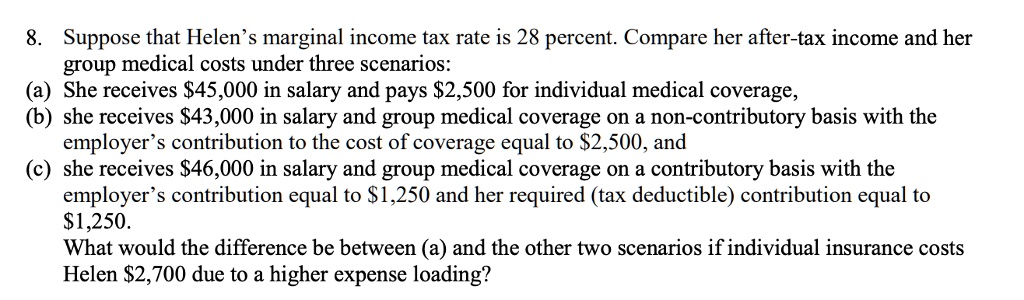

SOLVED: 8. Suppose that Helen's marginal income tax rate is 28 percent. Compare her after-tax income and her group medical costs under three scenarios: (a) She receives 45,000 in salary and pays2,500