Initial public offerings, bonus and rights issues will be eligible for concessional rate of 10% long-term capital gains (LTCG) tax even if the Securities Transaction Tax (STT) has not been paid earlier.

Difference Between Short and Long Term Capital Gains - Compare & Apply Loans & Credit Cards in India- Paisabazaar.com

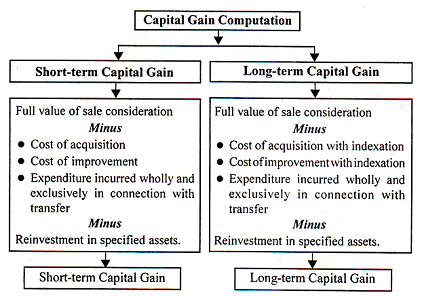

capital gain: How to calculate short-term and long-term capital gains and tax on these - The Economic Times

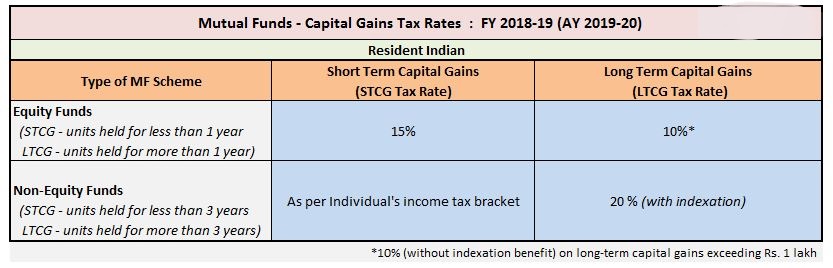

GoTaxfile on Twitter: "4 Easy steps to remember capital gain tax rates in India Article cover step 1: Listed security ( except debt units)- If held for <=12 months - STCG andIf